There was a lot of speculation as to how the stock market would react to the upcoming IPO of a well-known tech company. Some people thought that the market would go up, while others thought that it would tank. In the end, the market didn’t really move much at all. This could be due to a number of reasons, but it’s still interesting to know how the stock market reacts to these types of events.

What is IPO?

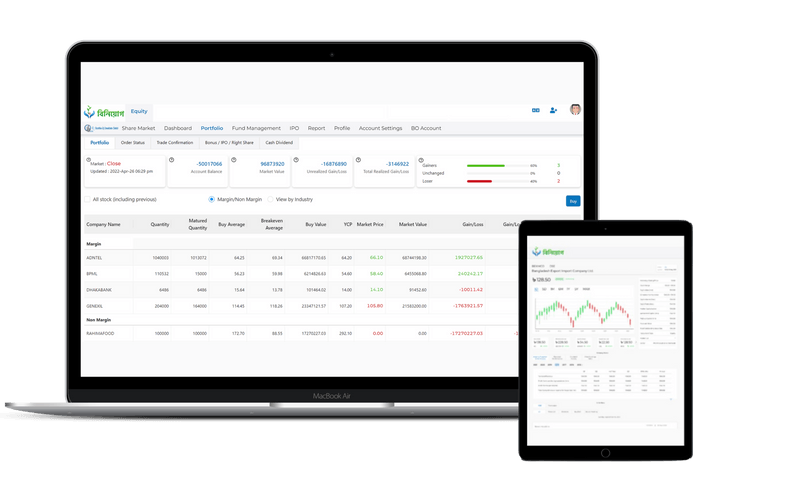

IPO stands for Initial Public Offering. It’s a process by which a company can go public and offer its shares to the public. The goal of an IPO is to raise money so that the company can grow and become more profitable. There are a number of factors that go into deciding whether or not to go through with an IPO, including the company’s financial condition, the industry it operates, and the overall market conditions.

The history of IPO

IPO has a long and complicated history that dates back to the early days of capitalism. Before IPOs became commonplace, companies would often go public by issuing new shares on the open market. This was a way for them to raise money and expand their operations.

Over time, IPOs have evolved into one of the most important ways for companies to raise money. Today, they are often seen as a sign of success and are closely watched by investors. IPO fever has been going strong lately, with several high-profile companies going public in 2017. There is no doubt that IPOs are an important part of the stock market landscape.

Type of IPO

There are a variety of different types of IPOs that can be undertaken, depending on the company, its stage in its development, and the investors it is targeting. Some common types of IPOs include:

-Initial Public Offering (IPO): A public offering where a company sells shares of its stock to the general public. This is often seen as a key step in raising capital for a company and allows it to raise money to fuel growth or finance new projects.

-Private Placement: A type of IPO where a company sells shares to select investors instead of the public. This can be useful for smaller companies who want to get access to higher-quality investors, or for companies who want to avoid public scrutiny.

How to prepare for an IPO

IPO preparation is crucial for any company that plans on going public. There are a number of things to consider, including preparing a business plan, creating a financial model, and drafting an investor presentation. Additionally, it’s important to have a clear vision for the company and its future trajectory, which can be conveyed in the S-1 filing. Finally, it’s essential to have relevant regulatory approvals in place before going public. Failure to prepare properly can lead to delays or even a company’s withdrawal from the IPO process altogether. Preparation is key – make sure you are up-to-date on all the latest tips and tools to ensure a successful IPO!

Preparation for IPO

Preparing for an initial public offering (IPO) is a complex and time-consuming process. Companies must review their financial statements and prepare a business plan, which will be submitted to the Securities and Exchange Commission (SEC). They must also hire an investment banker to help them raise money from investors. If everything goes according to plan, the company will file for an IPO on the stock market. There are many factors that can affect the success of an IPO, so companies must be prepared for anything.

Read About IPO

IPO is a term used to describe the process of a company going public. This means that it becomes available to the public through an exchange of stock. It’s one of the most important steps in a company’s development and can result in big changes for the business.prepare for an IPO

There are a number of things you need to be aware of before launching your own IPO. The first is that it can be complex and time-consuming, so make sure you have all the right paperwork in place. Secondly, make sure you have a good idea of what you want to achieve with your IPO. Do you want to raise money or grow your business? Once you’ve answered these questions, start planning how you will market your offering and attract investors.

Advantage an IPO

There are several advantages to issuing an initial public offering (IPO). Not only does this allow a company to raise capital and expand its reach, but an IPO also often results in increased stock prices. Additionally, an IPO can provide a company with a valuable platform from which to market its products and services.prepare for an IPO

Furthermore, being listed on the stock market can give a company better visibility and access to capital markets, which can be beneficial in times of need. Finally, an IPO can provide the founder(s) and early investors with significant returns on their investment.

Disadvantage an IPO

There are many disadvantages to launching an initial public offering (IPO). For a start, it takes a lot of time and effort to prepare the paperwork and organize the launch. Secondly, the price of the stock can be volatile, meaning that investors could lose a lot of money if the company’s performance is poor. Finally, there is always the risk that the company won’t be able to find enough buyers at an acceptable price, resulting in a loss for shareholders.

Final Thought

In conclusion, preparing for an IPO is a complex and time-consuming process. However, with proper planning, you can ensure a successful public offering. Be sure to consult with an experienced financial adviser to ensure that your preparations are on target. Finally, remember to stay positive and continue to keep your investors updated Throughout the process! Learn More!

Nice post. I learn one thing more challenging on different blogs everyday. It can always be stimulating to read content from different writers and follow a little something from their store. I抎 want to make use of some with the content on my blog whether you don抰 mind. Natually I抣l offer you a hyperlink in your web blog. Thanks for sharing.

I really wanted to develop a simple message to be able to express gratitude to you for these remarkable information you are placing here. My long internet lookup has now been recognized with reputable suggestions to go over with my family. I would declare that we site visitors actually are quite endowed to live in a good network with very many perfect people with insightful tricks. I feel quite blessed to have used the webpages and look forward to some more fabulous moments reading here. Thanks a lot again for all the details.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. Nevertheless just imagine if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and videos, this website could undeniably be one of the very best in its niche. Good blog!

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to create my own blog and would like to find out where u got this from. many thanks

I was pretty pleased to discover this web site. I need to to thank you for ones time due to this fantastic read!! I definitely liked every little bit of it and I have you saved as a favorite to see new things in your website.

I reckon something really interesting about your blog so I saved to bookmarks.